It's that time of year again. A new financial year beckons. It is time to prepare for completing your tax, and......

It is also time to build a business budget for the upcoming year.

Why Do You Need a Business Budget?

Whether you are launching a new business or managing an existing business, a Business Budget (or forecast) can help the likelihood of long-term success for your business. A budget helps you to see past next week and next month to the whole year, and importantly, a business budget helps you to track progress towards achievement of business objectives.

More specifically, a business budget can help your business benefit by:

- Making it more efficient

- Pointing out funds leftover that you can reinvest

- Predicting slow months and keeping you out of debt

- Estimating what it will take to become profitable

- Providing a window into the future

- Helping you keep control of the business

Creating a business budget will make operating your business easier and more efficient. A business budget can also help to make sure that you are spending money in the right places and at the right time to stay out of debt.

How to Create a Business Budget – a Step by Step Guide

The business budgeting process starts with looking backward at your business performance including your past income and expenses. The longer you have been in business, the easier this process will be, as you will have more historical data to look back on as you move to creating your forward-looking budget.

If your business is brand new, however, you might have to do some more extensive research into typical costs within your industry or area in order to gather working estimates for your forecasted finances.

Whether you are gathering information from within your own business or making estimated guesses based on research, there will be some legwork involved in creating your first working budget. That said, you might be surprised just how easy it is to create a business budget when you follow these steps.

Let's break down each step.

Step 1: Confirm Your Plan for the Oncoming Year

The first step is providing a context for your business budget.

Whether you are a new business, or a mature business you need to confirm your business direction for the 12 months, by identifying the key strategies for customer growth, cost reduction or efficiency.

For this step, start with reviewing your historical P&L. This will help you better understand the seasonal ups and downs of your business, which investments in your business are worth repeating, which new investments are going to important, and what you should avoid in the future.

Looking at your historical P&L's, look for these trends:

- Big supply or equipment purchases

- Seasonal trends due to inclement weather, natural disasters, or economic turmoil

- Seasonal trends due to school calendars, holiday patterns, or supply limitations

- Profit that is higher than in previous years

When examining your P&L, you are looking for ways to explain the fluctuations and changes in your business.

Then identify strategies for growth, cost reduction or efficiency.

As an example, for customer growth, ask yourself how many customers you will retain, how many new customers will be recipients of your products and services, and importantly what are the sales and marketing costs (ie staff, promotion, etc) for maintaining customers and acquiring new customers.

As an example, for efficiency, ask yourself how you can automate some of your time consuming activities, and importantly what the costs of addressing the automation including technology tools, and or services.

Step 2: Examine Your Revenue

The next step in the budgeting exercise is to build your revenue forecast for the next 12 months.

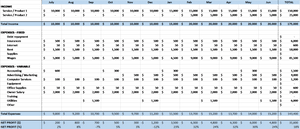

Based on your strategy for growth, and leveraging your understanding of previous years' performance, forecast the new revenue by month for the 12 months. Add the information as a ‘row’ in a spreadsheet – Revenue by month.

Hint: Be conservative.

In other words, make your income estimates on the low side.

Step 3: Examine Your Costs

The next step in creating a business budget is to add up all of your costs – both fixed and variable.

The term fixed costs applies to any cost that is necessary on a recurring basis for the operation of your business. Fixed costs might occur daily, weekly, monthly, or even yearly, so make sure to get as much data as you can.

Examples of fixed costs within your business might include:

- Rent

- Supplies

- Debt repayment

- Payroll

- Depreciation of assets

- Taxes

- Insurances

There are some key fixed costs you should review year on year. Note, typically, the largest costs for a small business are Rent, Payroll and Supplies. These need to be constantly reviewed.

Once you have identified your business’ fixed costs, you need to add the information as ‘rows’ in a spreadsheet – Costs (fixed) by type by month.

HINT: Use history as a guide for predicting the future

As you search for the data you need to list out your fixed costs, you might have also noticed there are some variable expenses within your business as well.

Variable expenses are those that change depending on how much you use the service. Many of these are necessary for your business to stay in operation, like utilities.

You will also find expenses in here that are not necessary for the function of your business, but would be nice to have, like education, or extras that can increase profitability. Those are called ‘discretionary expenses’, which you can roll into your variable expenses budget as well.

Some examples of variable expenses are:

- Owner’s salary

- Replacing old equipment

- Office supplies

- Professional development

- Marketing costs

- Utilities

During lean months, you will need to lower your business variable expenses, beginning with discretionary spending. During profitable months when there is extra income, however, you can increase your spending on variable expenses for the long-term benefit of your business.

Hint: Be conservative.

In other words, make your cost estimates on the higher side.

Once you have identified your business’ variable costs, you need to add the information as a ‘row’ in a spreadsheet – Costs (variable) by month.

Now, it is important to note that not all costs are equal. The focus should be on securing your business’ near-term viability and positioning your business for the medium-term.

Putting it another way, be careful when reviewing and potentially cutting costs. Do not remove all of your sales and marketing investment. Ultimately, businesses need to grow by ensuring they have a sales and marketing strategy that increases demand for your products or services.

Step 5: Create a Profit & Loss forecast

Once you have collected all of the above information, it is time to put it all together to create your profit and loss forecast.

Add up all of your income for the month and add up all of your expenses for the month. Then, subtract the expenses from the income and hope you get a positive number at the end.

If you do, you have made a profit! If not, that is a loss—and that is OK, too. Small businesses are not profitable every month, let alone every year. This is especially true when you are just starting out as a business.

The key point is achieving a profit overall for the whole year.

What is a good profit? Profit percentages (or Margins) differ by industry, but greater than 10% is healthy. For industry comparisons, my suggestion is you review

Benchmarks by industry | Australian Taxation Office (ato.gov.au),

Summary

Few business owners I have met love budgets, finances, and spreadsheets. It is simply not why they got into business ownership. But budgeting is part of life when you own a business. So, knowing step by step how to create a business budget and manage it efficiently will make your job as a business owner just a little bit easier.

Transcend is a team of experienced business coaches supporting You and Your business' growth.

For more information refer to www.transcendhcs.com.au.